does td ameritrade report to irs

152 reviews of TD Ameritrade If youre into online trading choose another online company and skip TD AMERITRADE. I suspect many traders will ignore the rule since theres no way for the IRS to know given current broker reporting.

Td Ameritrade Says I Made 196k In 3 Months R Tax

TD Ameritrade does not report this income to the IRS.

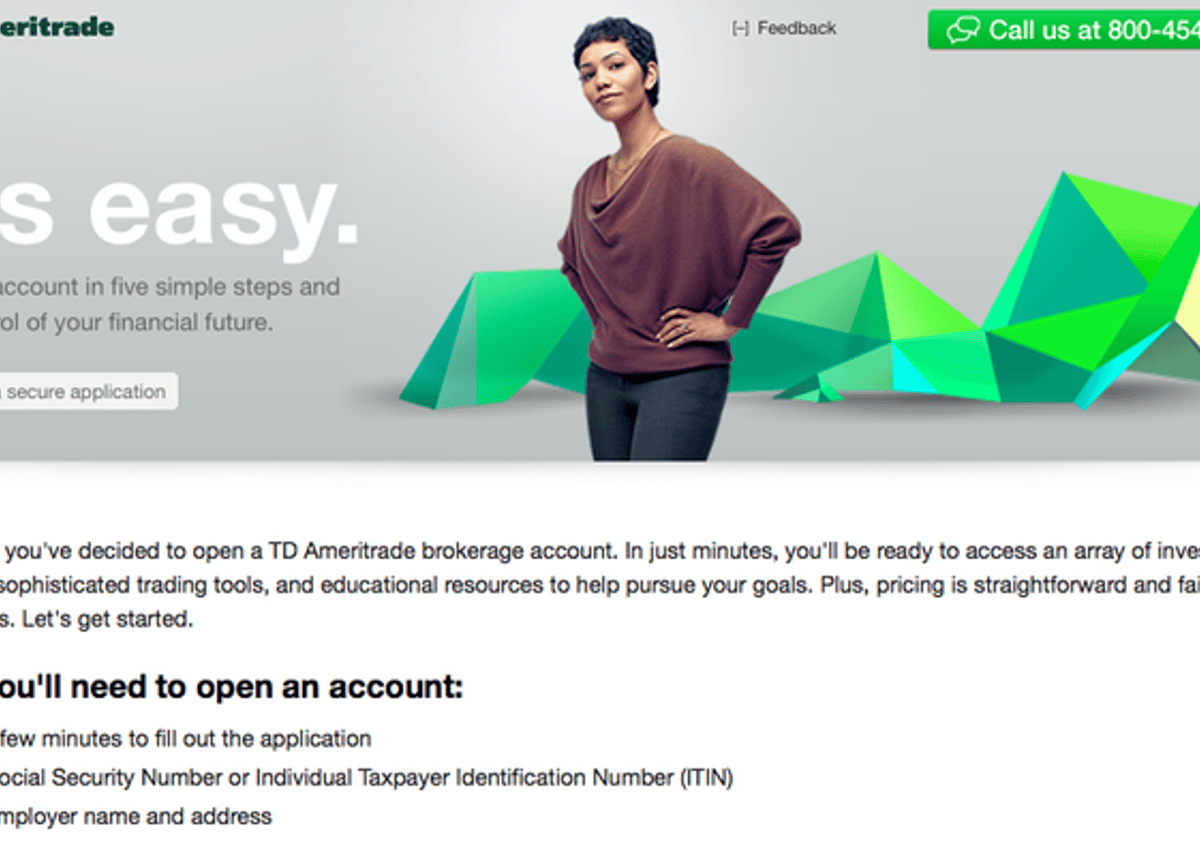

. That is withheld by TD Ameritrade Singapore and sent to the US. In this case the. This requirement to open an account is due to FINRA and SEC requiring it as well.

If TD cross checks your regular account and. TDA will provide you with a form known as a Consolidated 1099-B which includes all the information you need. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

That could change in the future. The IRS requires TD Ameritrade to report gross royalty payments of 10 or more on Line 2 of the 1099-MISC. Internal Revenue Service IRS on your behalf so no additional tax is due after the year ends.

TD Ameritrade does not report this income to the IRS. The reason for my 1 star review has much to do with their year end. TD Ameritrade does not provide tax advice.

The topic of this. In other cases TD Ameritrade Clearing Inc. Have you talked to a tax professional about this.

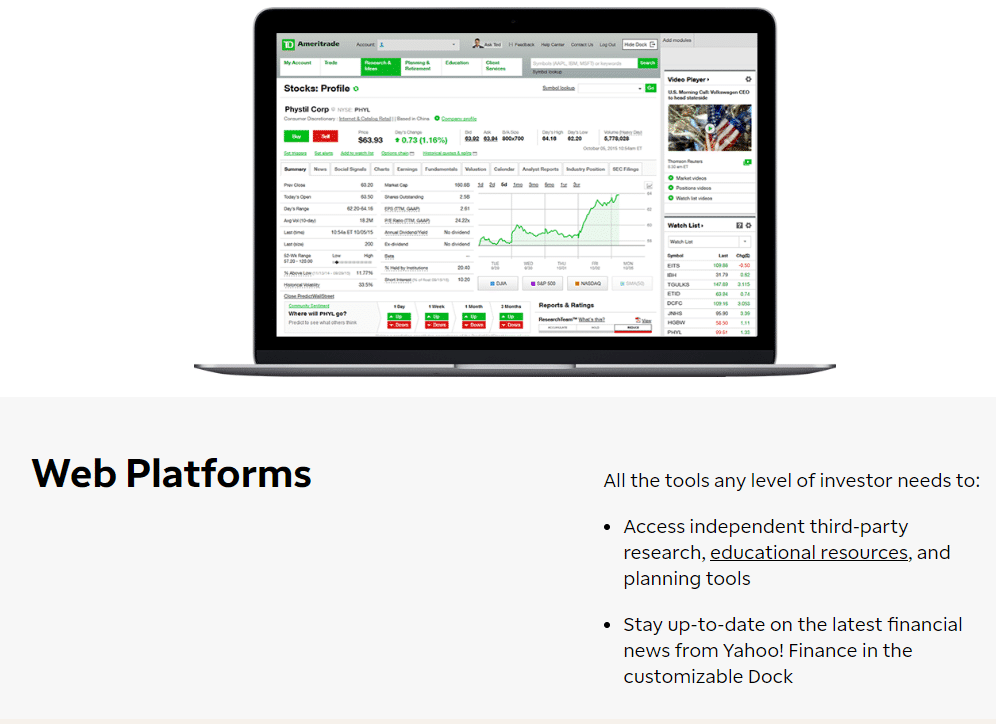

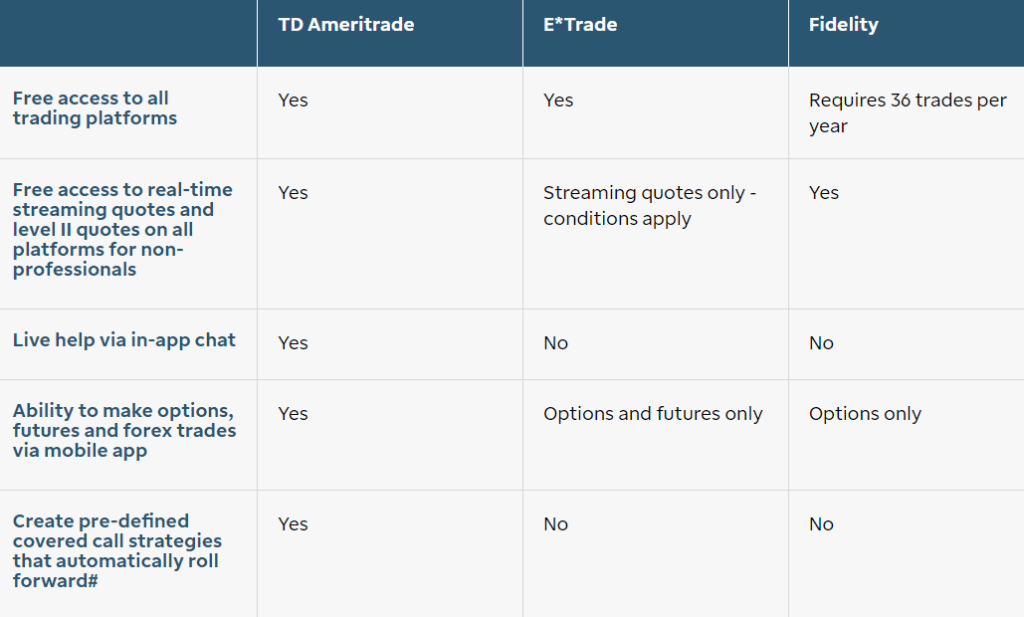

14 rows The Argus Research Market Watch one-page note is a comprehensive integrated report of analysis and information designed to help put the markets in perspective. While TD Ameritrade does not handle the administrative aspects of employer-sponsored retirement plans we are able to hold the assets in a tax-exempt trust account. I believe they report columns 1a through 1f on forms 8949 the gain or loss is.

The custodian bank is charged with safeguarding your financial assets to report required information to the IRS eg 1099s etc and provide you statements of your holdings. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. Payments to residents of Puerto Ricosuch as dividends interest partnership.

If you hold covered securities with tax-exempt original issue discount OID it will now be reported to the IRS on Form 1099-OID. Intraday data is delayed at least 20 minutes. You pay tax on it if you profit income tax rate if short term capital gains rate.

The statutory rate is 30 unless. TD Ameritrade does not report this income to the IRS. If you have any questions regarding your Consolidated Form 1099 please contact a Client.

But they do report the basis and sale price. Does TD Ameritrade take taxes. Many of these are now available I got mine online yesterday.

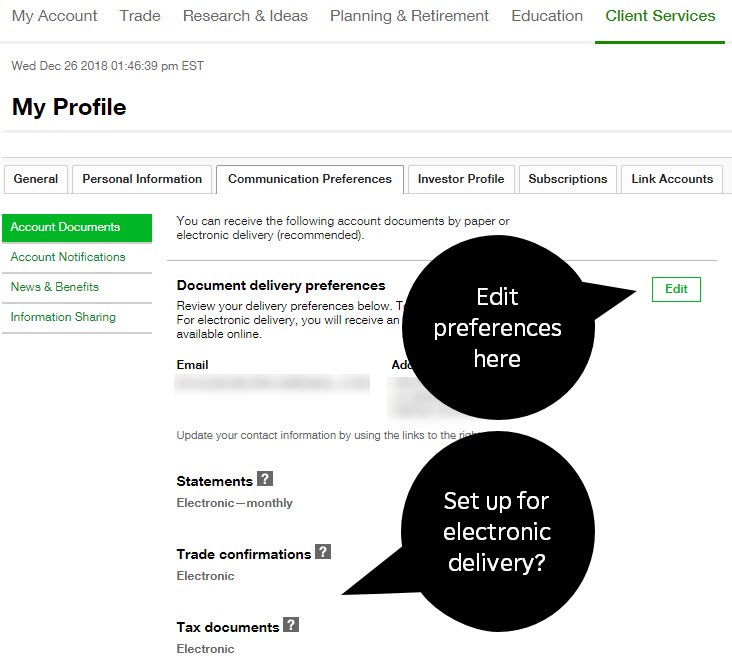

Download this file and submit it for processing by our program. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS. 4806a Informative Return Income Not Subject to Withholding.

TD Ameritrade provides a downloadable tax exchange format file containing your realized gain and loss information. They dont report the gain or loss to the IRS. Taxes related to TD Ameritrade.

Does Ameritrade report to the IRS. Because the IRS requires brokers to report the gross amount the amount listed. Document ID Number What does TD Ameritrade report to IRS-----The most important part of our job is creating informational content.

Form 1099 OID - Original Issue Discount. TD Ameritrade will also ask you for your social security or Taxpayer Identification Number TIN. Is required by federal andor state statutes to withhold a percentage of your IRA distribution for.

Td Ameritrade Says I Made 196k In 3 Months R Tax

Td Ameritrade Says I Made 196k In 3 Months R Tax

Td Ameritrade Headquarters Branch Locations Contact Info Map

What Is Schedule D How To Report Capital Gains And Losses

Td Ameritrade Review A Leading Online Stock Broker

Go Paperless This Tax Season Electronic Tax Forms Fr Ticker Tape

Our Td Ameritrade Review How To Get Started Pros Cons And More Navexa

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

How To Report Other Receipts And Reconciliations Partnership Distributions Received On A 1099 B From Td Ameritrade On My Tax Return Quora

Fillable Online View Td Ameritrade Fax Email Print Pdffiller

Td Ameritrade There May Be A Way Around The Penalty If You فېسبوک

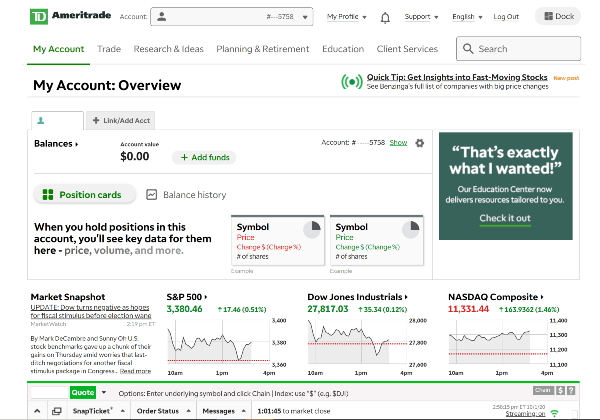

How To Sign Up For A Td Ameritrade Brokerage Account A Step By Step Guide

Td Ameritrade Review Top Ira Provider Good Financial Cents

Ameritrade Solo 401k My Solo 401k Financial

When Can I Expect My Tax Forms Merriman

Td Ameritrade Review A Leading Online Stock Broker

Choose The Right Default Cost Basis Method Novel Investor

Equities Hold Stocks Bonds Mutual Funds In A Self Directed Ira

.png)

How A Charles Schwab Td Ameritrade Deal Would Reduce Choice For Financial Advisors Financial Planning